For the past three weeks, Bitcoin has been moving within a sideways range, using important economic news as fuel for price impulse movements. The latest such event was the publication of the Consumer Price Index in the United States, ahead of which BTC/USD showed local growth but subsequently returned to the usual range of $28.5k–$30k.

The current trading week is characterized by the absence of significant economic factors, so there is no need to expect strong impulse price movements. Instead, Bitcoin will continue to move according to the local downward trend towards the $28.5k level. The asset will likely continue its downward movement to the $27.5k–$28k area, thereby updating the local low.

Accumulation period ends

Despite Bitcoin's sluggish price movement, investors are actively accumulating coin reserves for long-term storage. According to Glassnode data, long-term investors hold no less than 75% of the entire Bitcoin issuance, which is a high indicator pointing to the gradual end of the accumulation and redistribution period. However, the accumulation of such volumes of BTC does not indicate the beginning of a long-term bullish trend.

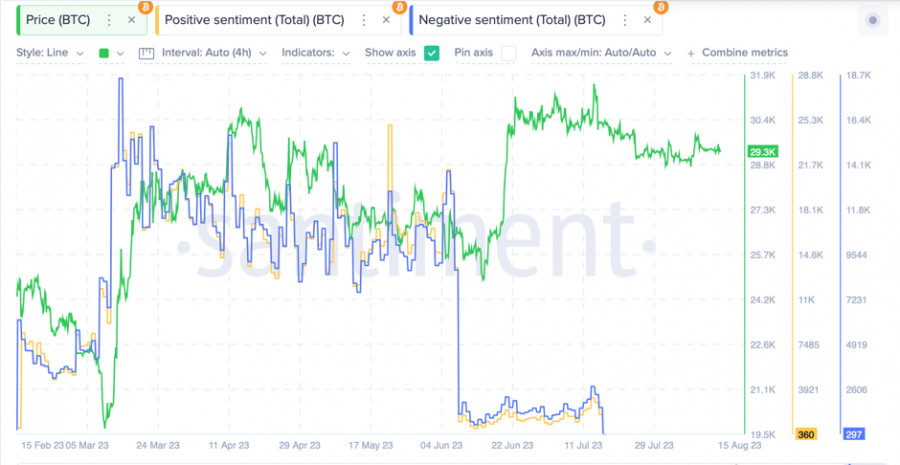

The Fear and Greed Index has been at neutral levels for the past two weeks, but market sentiment analysis indicates the absence of bullish sentiment. Considering that Bitcoin is in the framework of a local downward movement and is constantly under pressure from the trend, there is every reason to believe that the asset price will slowly slide to $28k–$28.5k.

BTC/USD Analysis

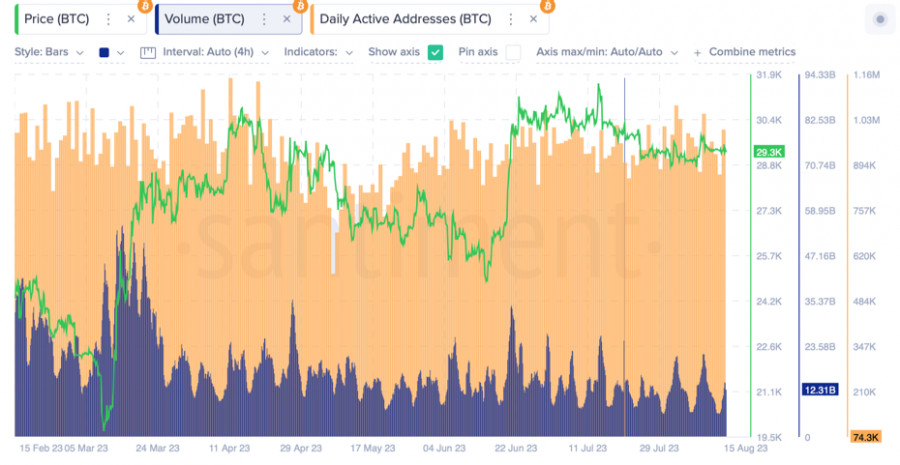

As of August 15, Bitcoin is moving near the $29.3k level, with daily trading volumes around $12 billion. The local support level at this stage is the $29k mark, but this threshold is not critical, and under selling pressure, it will not take long to break through. Therefore, the $28.5k–$28.7k zone can be considered the key level.

As for bullish hopes, BTC first needs to break through the $30k level, which is a mirror level since it previously served as an important support zone. Its breakout occurred on the eve of the Federal Reserve's rate hike, and therefore a large layer of sell orders has formed behind it over the past few weeks. Breaking through $30k signifies the end of the local corrective movement and a return to the impulse price movement within the framework of the global upward trend.

On the 1D chart, there are no signals for a strong impulse. At the same time, all metrics are moving downward, so BTC may inevitably retest $29k, and then move to $28.5k. Note that on the MACD, a green zone is starting to form, indicating a growing number of buyers. At the same time, RSI and stochastic continue their downward movement, so there is no basis for expecting signals for significant price changes.

Within the downward movement, Bitcoin has the potential to update the local low for two months near the level of $27.5k–$28k. We can expect a reversal in this zone when Bitcoin breaks through the $29k level. At the same time, it is necessary to take into account the growing number of buyers, which can neutralize bearish pressure and provoke a gradual price recovery.

BTC Price Movement Scenarios

In the first scenario, BTC/USD will continue to decline to the $28.5k–$29k area in low-volatility mode with trading volumes of no more than $15 billion. Such a scenario is quite likely, especially this week, considering the absence of significant news events. In this case, intraday trading becomes relevant with minimal volatility and the achievement of local targets.

The BTC price will likely begin a more rapid downward movement with increasing selling volumes. Such a scenario would allow for a quick pass through the $29k level and focus on $28k and $28.5k. However, for its implementation, large volumes and an important news event are needed as a catalyst for market activity.

We should not rule out the possibility that bulls will implement a multi-month accumulation policy. Local MACD signals on the growing number of sellers indicate the likelihood of an impulse price movement to consolidate above $30k–$30.2k. Such a scenario also requires significant news impact and large trading volumes. At this stage, a bullish breakout of $30k can be considered the least likely scenario.

Conclusions

Bitcoin continues its downward movement to $27.5k–$28k at low volumes, slowing the price movement. In the absence of significant news events, it can be assumed that the asset price will continue to move downward by inertia. At the same time, it is too early to talk about updating the local low, as there is an increase in bullish volumes and passivity of sellers.