Analysis of Trades and Trading Tips for the British Pound

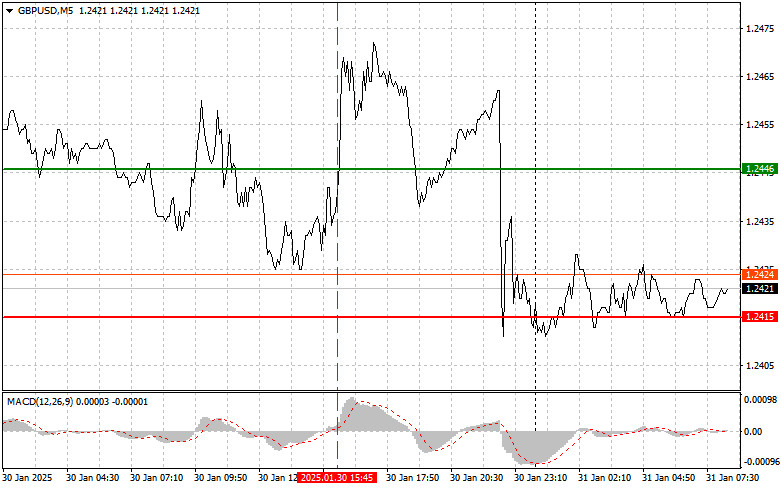

The 1.2446 price test occurred when the MACD indicator had already moved significantly above the zero mark, which limited its further upward potential. As a result, I decided not to buy the pound—a decision that turned out to be wrong. However, missing a trade is always better than taking a loss.

Weak U.S. economic data primarily affected the U.S. dollar. GBP buyers became more active in this environment, hoping for a weaker dollar. However, they soon faced new challenges, as the current economic conditions do not support sustained growth in the British currency, creating additional risks for long-term investments in GBP.

The U.S. president's tough stance on trade tariffs has only increased market uncertainty. Investors, concerned about potential global economic consequences, remain cautious about risk assets, sustaining demand for the dollar. Market participants will shift their focus to upcoming economic reports, which could impact the pair's dynamics. If the data show improvement, a short-term rise in the pound is possible, but risks remain high.

Today's Nationwide House Price Index, while important for analyzing the real estate market, is unlikely to trigger significant market movements in the UK economy. Given the current market conditions, traders do not expect sharp changes, meaning GBP will likely remain under pressure. Investors will closely monitor the data but hopes for positive shifts appear unjustified for now. Additionally, the pound sterling faces additional challenges with recent economic indicators and political instability. The Nationwide Index serves only as one of many indicators in a broader analytical spectrum, and its impact will be indirect. More significant market movements require stronger data releases or policy changes that could restore investor confidence in the UK economy.

I will rely primarily on the implementation of scenarios No.1 and No.2.

Buy Signal

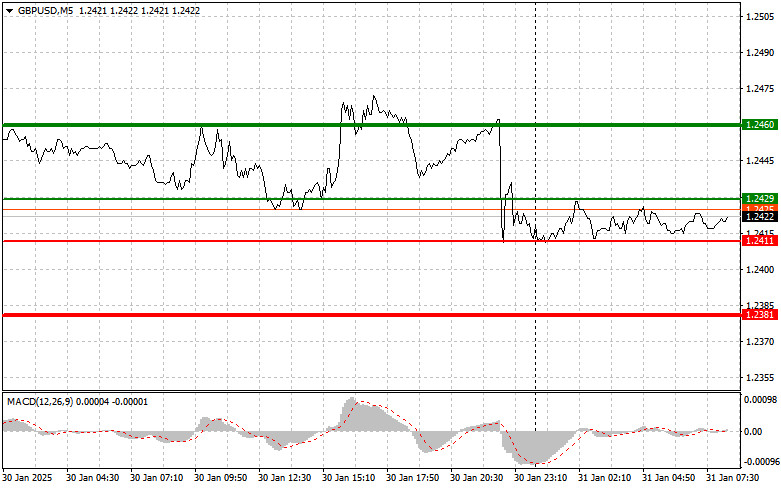

Scenario No.1: Today, I plan to buy GBP upon reaching the 1.2429 entry point (green line on the chart), with a target at 1.2460 (thicker green line). Around 1.2460, I will exit purchases and open sell positions in the opposite direction, expecting a 30-35 pip retracement from the level. Counting on a GBP rally in the near term is unlikely. Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario No.2: I also plan to buy GBP today in case of two consecutive tests of the 1.2411 price level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and lead to an upward reversal. Growth toward the opposite levels of 1.2429 and 1.2460 can be expected.

Sell Signal

Scenario No.1: I plan to sell GBP today after a break of the 1.2411 level (red line on the chart), which should lead to a sharp decline in the pair. The key target for sellers will be 1.2381, where I plan to exit sell trades and immediately open buy trades in the opposite direction, expecting a 20-25 pip retracement. Selling GBP from higher levels is better, as this trade will go against the trend. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario No.2: I also plan to sell GBP today in case of two consecutive tests of the 1.2429 price level while the MACD indicator is in the overbought zone. This will limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.2411 and 1.2381 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.