Trade Analysis and Tips for Trading the Euro

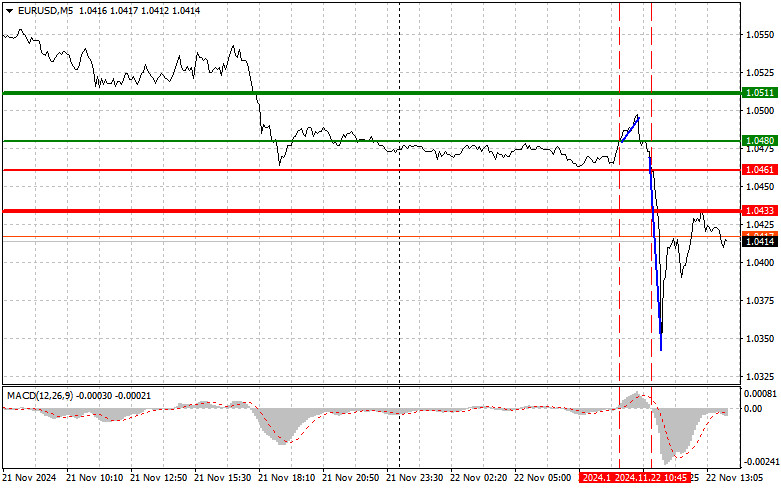

The test of the 1.0480 price level occurred as the MACD indicator began moving upward from the zero line, confirming a valid entry point for buying the euro. As a result, the pair rose by 20 points before losing momentum. A more effective short entry occurred at the 1.0461 price level. Combined with weak PMI data from the Eurozone, this triggered a sharp drop of over 100 points.

With the Eurozone economy teetering on the brink of recession, it is unsurprising that the European Central Bank remains prepared to raise interest rates aggressively. The possibility of a 0.5% rate hike at the December meeting now appears highly likely. Amid growing uncertainty, European policymakers face the challenge of promoting growth while managing inflation risks to avoid a prolonged crisis. Whether Europe can strike the right balance and regain investor confidence remains to be seen.

Today, US PMI data, which could pressure the euro further, will be released alongside the University of Michigan's Consumer Sentiment Index. This index, a key indicator of household confidence, reflects public perceptions of financial prospects and the broader economy. It is expected to signal future consumer spending trendsЧa critical driver of economic growth.

Additionally, the US inflation expectations report will be published. Because consumer confidence and inflation expectations are closely linked, their trends may reveal how consumers intend to respond to future economic changes. This, in turn, could influence Federal Reserve decisions on monetary policy. With slim chances of a euro rally today, I expect continued strengthening of the US dollar. My intraday strategy focuses on Scenarios 1 and 2.

Buy Signal

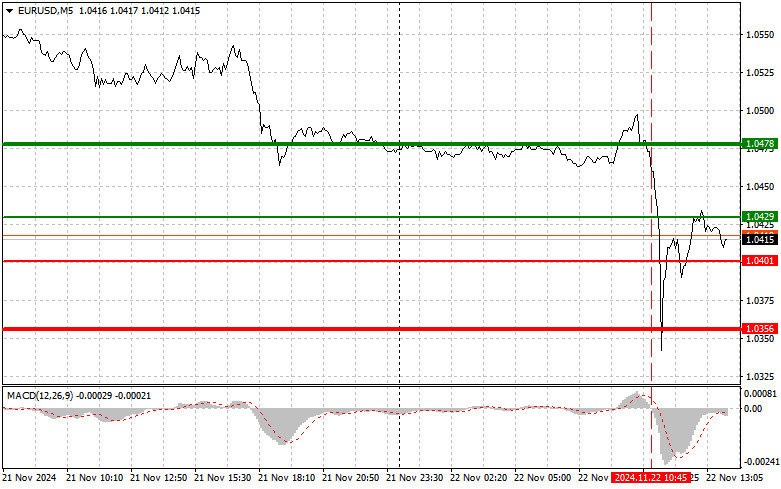

Scenario 1: I plan to buy the euro if the price reaches approximately 1.0429 (green line on the chart), with a target of 1.0478. At 1.0478, I plan to exit the market and initiate a sell position, aiming for a movement of 30Ц35 points from the entry point. Significant growth in the euro will depend on very weak US data.Note: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario 2: I also plan to buy the euro today if the price tests the 1.0401 level twice, while the MACD indicator is in the oversold zone. This setup will limit the pair's downward potential and could prompt a reversal upward. In this case, I anticipate growth toward 1.0429 and 1.0478.

Sell Signal

Scenario 1: I plan to sell the euro if the price reaches 1.0401 (red line on the chart). The target will be 1.0356, where I will exit the market and initiate a reverse buy position, aiming for a rebound of 20Ц25 points. Strong US data could increase pressure on the pair.Note: Before selling, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario 2: I also plan to sell the euro today if the price tests the 1.0429 level twice, while the MACD indicator is in the overbought zone. This setup will limit the pair's upward potential and could lead to a reversal downward. In this case, I anticipate a decline toward 1.0401 and 1.0356.

What's on the Chart:

- Thin green line: Suggested entry price for buying the trading instrument.

- Thick green line: Target price for setting a Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Suggested entry price for selling the trading instrument.

- Thick red line: Target price for setting a Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, focus on its position relative to the zero line and whether it is indicating overbought or oversold conditions.

Important Notes for Beginners

Beginner traders in the Forex market should exercise caution when making entry decisions. It is advisable to stay out of the market before the release of major fundamental reports to avoid sharp price fluctuations. If you choose to trade during news releases, always set stop-loss orders to minimize risks. Without stop-loss orders, you could quickly lose your entire deposit, especially if you trade large volumes without proper money management.

For successful trading, a clear planЧlike the one outlined aboveЧis essential. Spontaneous trading decisions based on immediate market movements are often a losing strategy for intraday traders.